German water sports market is growing - euro debt crisis take the momentum relaxation of international:

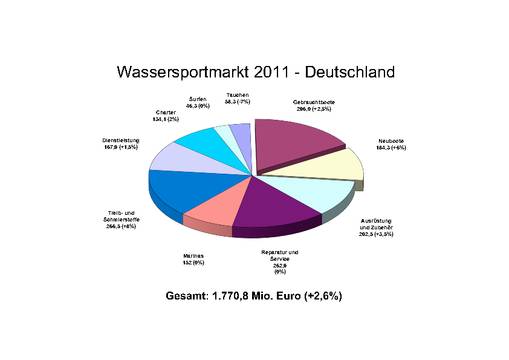

Trust in a positive economic development of the water sports industry in Germany is still there, even if the companies have withdrawn their expectations for the future a little. This is the result of the economic survey of the Federation Watersports business end of the year.After the deep valley in the wake of the global financial and economic crisis and the significant recovery in 2010 with an increase of the German boat production by nearly 30 percent of the recovery is in the maritime industry in 2011 continued. 50.7 percent of companies surveyed in late November, the fiscal situation has improved over the previous year. Only 25.7 percent speak of losses. This is also the current production figures of the German boot manufacturers. In 2011 the production of sailing and motor yachts in comparison to the previous year to increase by almost 20 percent. Overall, the industry expects for 2011 a turnover of marine goods and services (excluding mega yachts) from 1.77 billion euros (+2.6 percent).

International market recovery uneven

International considers the recovery of the markets developed quite differently. While in Northern Europe, the demand for boats and yachts in total increases, the situation in Southern Europe, at least very different. A sustained recovery is in sight and is the financial cost tense situation in some southern European countries not exactly likely.The mixed performance in international markets is also reflected in the development of exports. The German boat manufacturer, in the first half of 2011 set in the sail boat range in value by 14.6 percent and 12.2 percent for boating on the foreign markets. This leaves behind the international development of the German market.

Moreover, it may, the success of the years 2010 and 2011, not hide, the boat manufacturers are still far from the level of sales peak years from 2006/2007. According to calculations of the Association of recreational boating industry, the production is currently about 65 percent of the level before crisis.

Sailing and motor yachts

The demand for motor and sailing yachts has increased. 69.8 percent of the sailing boat dealer (previous year: 64.6 percent) speak of equal or better sales results compared to the previous year. The boating comes with almost 69 percent on the same value. After a good show season 2010/2011 and the highlight of the season with Dusseldorf boat sales success was encouraging, however, demand in the second Noticeably after quarter of 2011. Only in the summer, the situation stabilized again, but overall remained below expectations for the year 2011.

In terms of future economic development in Neubootgeschäft the situation remains confused. Under the influence of the growing sense of crisis in international financial markets, the consumer climate cools but as a whole, on the other hand, the increasing tendency of consumers to high-value purchases. This benefits not only the real estate market, but also a part of the boating market. The low returns that are currently allowed to achieve savings and asset inflation fears seem to spur this trend.

The trend is still fully equipped boats and yachts in the lower and mid-size and price range. This desire by many manufacturers are inexpensive entry-level versions and receive discounted equipment packages. In the high-priced area, the situation of the low investment potential buyers will want the one hand and the busy hand yacht market on the other tense.

Used Boats

The business with well-maintained boats and yachts from the second hand has continued to improve. About two-thirds of the used boat dealers and brokers report similar or better results than last year. Especially newcomers to the sport boat to take this opportunity to gather some experience on the water. A wide range in recent years and the sharp decline in sales prices make the used boat market attractive.

Equipment, accessories, repair and serviceThe demand for high quality marine equipment and accessories at retail level remains unchanged at a high level, even if the poor summer in Germany led to a significant decline in demand in July and August. Overall, the accessories industry records for the year, an increase of three to four percent compared to last year.

From the used boat business, but also by the decision of many boat owners in the value of their ships to invest to benefit the companies that specialize in repair and service. The occupancy rate is still outstanding. 91.5 percent of companies rate the business as well or better than last year. However, the shortage makes it increasingly more noticeable in the technical field and thus sets the limits of positive development.

Rental

The trend to spend the best weeks of the year in Germany, by the rainy summer has received a significant shock. In particular, the short-term bookings for sailing and motor yachts on the Baltic coast and inland, have been significantly lower than expected. Nevertheless, the industry is due to complete by the summer of good advance bookings for the year, with shops on the previous year. Slight increases (+ four percent), however, list the provider of charter trips abroad.

The landlord of canoes / kayaks can look back on a very successful year. 87.5 percent of providers report equal or better business over the previous year. The canoe rental companies, which have at their offerings in recent years to set clear service and environmental quality remain so for growth.

Diving

The political turmoil in Egypt and the damage it caused major declines in the diving industry for the region have left not only with the travel industry, but also in the diving industry tracks. The Diving Industry Association (tiv) estimates for 2011 for the first time after many years of growth, with sales falling by around eight percent. However, the diving is that consumers will continue the trend. Although the numbers are international training significantly decreased due to the situation in Egypt, Germany, the schools reported, however, still increases. A study of the tiv is at the present boat in 2012 investigated the claims of the first divers to dive sites and gives investors suggestions and assistance. This study will be the diving sport in Germany and further promoted new waters for this great sport to be developed.

View

Overall, the medium-term economic trend of the company will continue to be positive. For the next two to three years, expect 35.6 percent of German companies expect further growth, 43 percent, with sales at the current level. In the previous year, nearly twice as many companies expected an increasing volume of business. The future expectations of the company from falling so much more subdued than they were a year ago.

For export-oriented enterprises, the situation remains unclear. In the euro debt crisis countries particularly affected because of the increased risk of refinancing costs now become necessary austerity measures to destabilize the already weak economy even further.

In addition to economic challenges facing the industry but we also create structural problems. For further positive development, the introduction to the boating more attractive and easier. The significant reduction of questions to the official sport boat driving licenses, which are force in 2012 are, in this context, an important signal dar. also an extension of the license-free area is on the political agenda (see report in this issue). But the industry is required to open up a hand with innovative concepts, new boat buyers and draw the other to a joint advertising campaign more interest in boating.

German original version / Original-Version in deutscher Sprache :

Bundesverband Wassersportwirtschaft e.V

Aucun commentaire:

Enregistrer un commentaire